If you’re like most people, you have a number in your head that represents the total value of your investments. But what does that number actually mean? And how should you go about dividing up your investments among different asset classes and individual investments? This article will explain how to determine and interpret the value of your investments. You’ll learn what a stock is and what drives its price, as well as the importance of diversification in investing. You’ll also learn about NFTs and diamond trends.

The Importance of Diversification In Investing

No one can predict with certainty which investments will perform best in the future. It is therefore essential to diversify your investment portfolio by including a variety of asset types. This will help to minimize your risk and maximize your potential for return.

There are a number of factors to consider when determining the value of your investments. The most important of these is the current market conditions. It is important to stay up to date on market news and trends so you can make informed decisions about which investments to buy and sell. Another factor to consider is the underlying asset of the investment. Some assets are more volatile than others and may be more or less risky depending on your personal risk tolerance. Consider the fees associated with each investment. These can vary significantly from one investment to another, so it is important to do your research and find the best deal.

Remember that investing is a long-term game. Investments that may seem like poor choices today may be the best options in the long run. Conversely, investments that seem like a good choice today may not be as good a choice in the future. So, be patient and stay the course, and you will be sure to see long-term success.

Interpreting Non-Fungible Tokens

The first step in determining and interpreting the value of your investments is to gain an understanding of what a NFT is and how it works. NFTs are tokens that represent unique digital assets. They can be used to represent anything that has value, from virtual goods to real estate. They are created on blockchain platforms, which are distributed ledgers that keep track of all transactions. This makes them secure and tamper-proof. There are many factors that contribute to the value of an NFT, including but not limited to the rarity of the NFT, the utility, the demand, the size, and the age. The more rare an NFT is, the more valuable it is likely to be due to high demand.

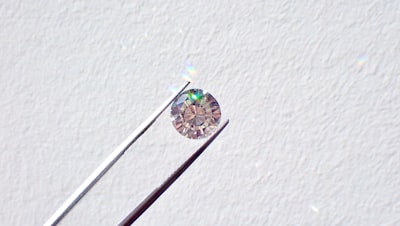

Jewels and Diamonds

When it comes to valuing diamond jewelry, there are a few things to consider, such as diamond trends, carat weight, cut, age, and more. Carat weight is the size of the diamond and is the most important factor in determining value. Cut is how well the diamond has been cut and includes the height, depth, angles, and other factors. It affects the diamond’s symmetry, brightness, fire, and how sparkly the diamond appears. Clarity is how many blemishes or inclusions and is judged on a 6-point scale from included to flawless. Color is judged on a scale from D (no hue) to Z (a yellow-hued diamond). Diamonds that are mined in certain parts of the world can be more valuable than others. Diamonds that have been treated, such as those that have been laser-drilled or fracture-filled, may be worth less than those that are untreated. The age of the diamond can also affect its value.

Asset Class Breakdown

Break down your net worth by asset class. This includes stocks, bonds, real estate, and cash. The value of each asset class will change over time as the prices of the investments fluctuate. To calculate the value of each asset class, divide the total value of the asset class by the total value of your net worth. For example, if the total value of your stocks is $10,000 and the total value of your net worth is $20,000, the value of your stocks is 50%.

The next step is to break down your net worth by individual investment. This includes stocks, bonds, real estate, and cash. The value of each investment will change over time as the prices of the investments fluctuate. To calculate the value of each investment, divide the total value of the investment by the total value of your net worth. For example, if the total value of your stocks is $10,000 and the total value of your net worth is $20,000, the value of your stocks is 50%.

Hopefully, this guide has been helpful in determining the value of your investments.